8 Ways Carriers Can Win Big in a Rolling Recession

Keith LaBotz - June 29, 2023

Successful transportation companies keep their trucks rolling, and that’s easier when the economy is on a roll. But what happens when it's a recession that’s on a roll?

A “rolling recession could mean a rough road ahead for many transportation carriers. The good news is that carriers can take measures to navigate this new challenge, and understanding the problem is the first step.

What is a rolling recession? Instead of the traditional recession that simultaneously dips the entire economy, a rolling recession moves from sector to sector. Some industries contract while others expand through a series of market corrections that are seemingly random. The result is an unpredictable and perplexing economic picture.

Rolling Recessions Cause Volatility

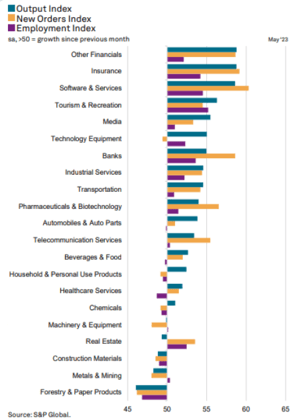

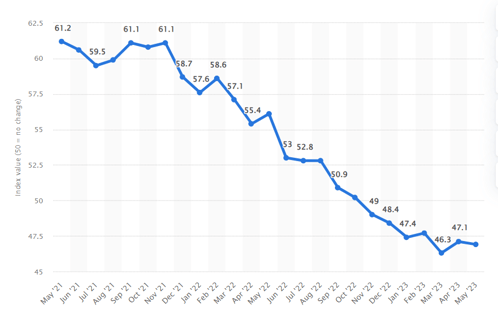

Comparing the May 2023 ISM Manufacturing Purchasing Managers Index and S&P Global Purchasing Managers Index hints at the problem. The ISM index (below right) illustrates two years of contraction, while the S&P shows a mixture of growth and recession across different sectors. The alternating expansions and contractions are a recipe for supply chain volatility, which spells trouble for transportation providers.

Rolling Recessions Are Hazardous for Transportation Carriers

The hazard of a rolling recession to transportation carriers lies in the transference of volatility from shippers to the carrier’s delivery network. Carriers service customers across diverse industries, and sudden economic contractions and expansions in customer businesses can disrupt carrier operations. With recession rolling from one sector to another, the carrier is subject to ongoing volatility.

8 Solutions for Mitigating Rolling Recessions

To manage the volatility of rolling recessions, a carrier must strive to increase operational agility. Several process improvements working in concert can achieve that significantly increases in profitability and resilience, resulting in a big win for the carrier.

1. Increase Visibility: The primary defense against volatility is end-to-end data visibility that extends across the entire delivery network and into customers’ shipping operations. Real-time visibility is essential for early detection and correction of disruptions.

2. Strive for Collaborative Planning: Significant gains are possible from synchronizing logistics processes, and it’s only possible by integrating planning with every software system managing fleet operations. The vision for planning should be collaboration beyond the enterprise, integrating with interlining and intermodal partners and shippers (customers).

3. Leverage Predictive Analytics: Data-driven decisions significantly improve carriers' resilience to external shocks. Predictive analytics improve forecasts and detect anomalies that arise from volatility, reducing the uncertainty and risk that characterizes rolling recessions.

For example, Live Analytics is a technology from flexis AG that detects trends, calculates probabilities, and discovers hidden relationships between operational variables. These insights are combined with transportation planning and what-if simulations to identify a broader range of optimization opportunities, increasing profitability.

4. Transportation Planning and Scheduling: Planning software that optimizes the delivery network adjusts scheduling as conditions change and minimizes the Total Landed Cost (TLC) for every shipment. A delivery network must continuously update transportation to respond proactively to volatility.

5. Vehicle Routing and Scheduling (VRS): Dynamic route planning ensures vehicles follow the most cost-efficient routes given current resources, demand, road conditions, and fuel consumption. Fleet resources are optimized to yield maximum capacity and profit margin.

The best VRS solutions integrate tightly with transportation planning to maximize profitability and agility at every stage of the delivery process.

6. Shipment Consolidation: Combining shipments into single delivered and assigning multiple shipments to multi-stop truckloads.

7. Loading Optimization: Software that automates the sequence and position of lading shipments ensures efficient, full utilization of trailer space and the most efficient unloading sequence.

8. Multimodal Optimization: Planning that supports multiple transport modes like parcel, rail, ocean, barge, and air freight networks expands transportation capacity and increases coverage. The extra capacity makes the delivery network more resilient in a volatile environment. The added coverage increases sales opportunities and options to reduce costs, boosting competitiveness. %20process.jpg?width=624&height=386&name=flexis%20Vehicle%20Routing%20and%20Scheduling%20(VRS)%20process.jpg) flexis AG provides a cloud-based suite of solutions that includes the abovementioned solutions in an integrated framework that optimizes operations across a carrier’s delivery network. It is effective for both common carriers and private transportation fleets and can support all modes of transportation. Available in the cloud, transportation providers can quickly implement the improvements discussed.

flexis AG provides a cloud-based suite of solutions that includes the abovementioned solutions in an integrated framework that optimizes operations across a carrier’s delivery network. It is effective for both common carriers and private transportation fleets and can support all modes of transportation. Available in the cloud, transportation providers can quickly implement the improvements discussed.

Conclusion

While a rolling recession presents significant challenges for transportation providers, the improvements introduced in this article can protect carriers from the harmful effects of rolling recessions and win big in the competitive market.

If you want to learn more get your Guide to Logistics 4.0

In this Guide you will learn:

-

Why a strategic process in transportation planning is a top priority for digitalization

-

What megatrends will increase supply chain volatility

-

How to manage it

LATEST POSTS

- Understand Circular Economy in The Manufacturing Industry

- How Can Industry 4.0 IT Integration Be Achieved Smoothly?

- The Significance of Order Sequencing in Discrete Manufacturing

- How to improve your Supply Chain Management: The Power of Control Towers

- Optimizing Human Resource Scheduling in Manufacturing: A Technological Approach