Recession Proof Your Supply Chain with This Great Solution

Keith LaBotz - October 07, 2022

Are transportation trends signaling a recession, and is your company prepared for what’s coming?

If you want to recession-proof your company, you might find transportation indexes a valuable additive for your supply chain management systems. Knowing how to use them can increase profits on the upside and downside of economic cycles. It can even predict those cycles, giving your company more time to prepare.

Read on to learn more about this great solution.

Transportation is an Economic Indicator

Transportation is an economic indicator - as transportation goes, so goes the supply chain and the economy. Because transportation is the core of every supply chain, all supply chain processes ultimately link to a shipment, and this has far-reaching implications:

- A supply chain is only as healthy as its transportation process.

- An economy is only as healthy as its supply chain.

These dependencies transfer to forecasting; transportation industry trends reflect economic trends. The data points used to chart transportation trends are a proxy for the economy. These data points can be utilized in supply chain forecasting, planning, and execution systems to improve decision-making.

Align With Transportation to Align With Economic Trends

In effect, guiding decisions with this data aligns supply chain processes with economic trends. Steering a supply chain along these trends will help your company navigate economic change with more confidence.

Let’s look at a couple of charts to see how this approach works.

Outbound Tender Volume Trends Predict Recession

The chart below shows the tender volume for truckloads declined in 2022 and recently plumbed October 2019 levels, the last time global recession fears dominated headlines.

Source: Freightwaves

The almost-recession of 2020 was overshadowed by COVID and forgotten as supply chains spent more than two years combatting a supply chain wildfire. With volatility and demand subsiding, the transportation outlook resembles the pre-COVID world. That’s a summary of the story presented in the chart, and it leads to some conclusions:

- Recessions are a vital correction in economic cycles, marked by declining demand and tender volume.

- Stimulus spending can pump up demand temporarily to delay a recession, but the correction resumes once the stimulus wears off.

- Short of an economic miracle or more intervention, demand and tenders can be expected to decline until correction completes.

Transportation Pricing and Capacity Trends Predict Recession

Source: Logistics Managers Index

Let’s look at the September 2022 Logistics Managers’ Index (LMI) to see if our conclusions hold. Last month, the LMI transportation capacity index jumped to 71.8, the second-highest level in its history. That’s 48 points higher than in 2020 following the lockdowns. Excess capacity is worse now due to an influx of new drivers over the past two years.

LMI’s transportation pricing index is in a nosedive, even with inflation pushing cost per mile to record highs. With consumer confidence surveys hitting record lows, capacity and pricing deterioration will likely continue this trend.

LMI reports, “This month’s reading only trails behind April 2019’s reading of 72.0 — a reading which marked the beginning of the freight recession of 2019. Whether or not a freight recession similar to what we saw in 2019 is imminent, it is clear that the snapback that was always going to come after two straight years of contraction is here.”

Follow the Money to Your Conclusions

You can validate conclusions by following the money - the actions of businesses in response to transportation trends. Here are a few recent news items to check the interpretations given for these charts:

- Ocean carriers are canceling dozens of sailings on the world’s busiest routes during their peak season, the latest sign of the economic whiplash hitting companies.

- US truckload spot prices have dropped 33% since January 1, 2022, and freight rates are eroding in all modes of transport and virtually every lane.

- KeyBanc transportation analysts just warned of a “trucking winter” and downgraded earnings for trucking giants JB Hunt and Schneider.

- A couple of weeks ago, FedEx announced its plan for aggressive cost-cutting measures due to deteriorating macroeconomic conditions.

Transportation Indexes Improve Forecasting

Integrating transportation indexes into supply chain forecasting can improve its accuracy. Indexes synthesize countless market and economic variables; they are an aggregate demand analysis across many companies and industries. A correct conclusion about a transportation trend is also an economic prediction, and that's what forecasting and planning strive for.

Transportation Indexes Are Powerful and Convenient

Industry indexes are a compact, potent parameter for reducing decisions to a simple binary choice. This topic needs more space than this post permits, but the basic approach for using index data can be as simple as this:

- A healthy transportation outlook = a healthy economy.

- Dropping capacity = higher prices.

- Fewer tenders = more capacity.

Transportation Indexes Increase Agility

Synchronizing transportation and production planning with transportation trends enables better carrier collaboration, enhancing agility and the ability to secure capacity.

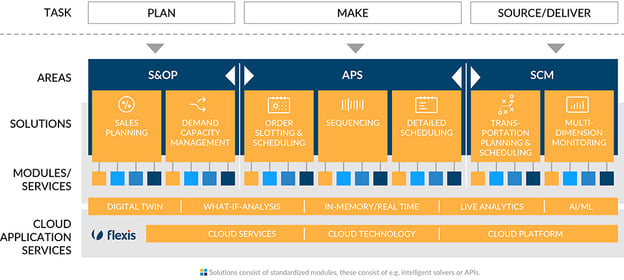

The flexis suite of apps seamlessly integrates S&OP (Sales & Operations Planning), APS (Advanced Planning & Scheduling), and transportation forecasts to make supply chain optimization possible. Incorporating transportation indexes into forecasting and planning synchronizes all three areas in alignment with transportation and economic trends.

Conclusion

Incorporating transportation indexes into supply chain forecasting and planning is the best way to recession-proof a supply chain. The proposed solution is implemented quickly and maximizes profits on the upside and downside of economic cycles.

INTERESTED IN MORE INFORMATION?

LATEST POSTS

- Understand Circular Economy in The Manufacturing Industry

- How Can Industry 4.0 IT Integration Be Achieved Smoothly?

- The Significance of Order Sequencing in Discrete Manufacturing

- How to improve your Supply Chain Management: The Power of Control Towers

- Optimizing Human Resource Scheduling in Manufacturing: A Technological Approach