Ten Ways Restructuring Supply Chains Improves Transportation

Keith LaBotz - November 03, 2022

Restructuring your supply chain can protect it from geopolitical risks like rising fuel costs and transportation delays. Understanding this could mean the difference between leapfrogging past competitors or falling behind in the coming months.

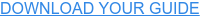

A recent McKinsey article notes companies that emerged as the winners from the last recession reacted when it mattered most, opening an early lead that widened significantly over time. The gist of this article is that resilient companies proactively mitigate risks and boldly act on new growth opportunities.

This recession differs from previous ones and requires different actions to reduce risks and create opportunities. Let’s begin with supply chain risks.

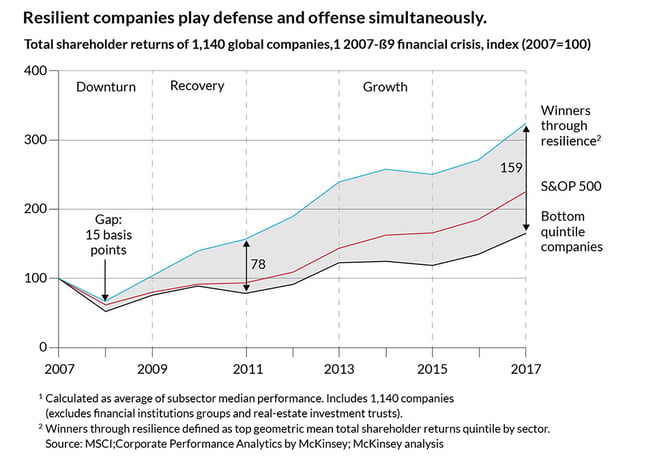

Businesses face a deeply troubled economy, and potentially existential threats arrive through a global supply chain structure that transfers risk. The past two years demonstrated how a distant crisis could quickly become a local problem. Lockdowns and, more recently, the stoppage of Russian fuel revealed how geopolitics could unexpectedly jeopardize business viability.

At present, the biggest concern remains energy and it will likely reach a crisis if the current trajectory remains unchanged. While there is nothing your company can do to alter energy policy, restructuring supplier and transportation networks can reduce the impact of these policies.

Risk is a Structural Problem for Supply Chains

The first step is understanding that the global supply chain is agnostic when it comes to geopolitics, but it delivers the consequences without prejudice. It’s a structural problem in your company’s supply chain network that permits someone else's virus to infect its business. Your supply chain needs a firewall to protect itself from this risk, beginning with transportation.

Transportation is Key to Mitigating Geopolitical Risk

Transportation is Key to Mitigating Geopolitical Risk

Transportation is the core of every supply chain, and it’s key to relocating suppliers and factories to insulate operations from geopolitical risks. Geopolitical strategist Peter Zeihan called attention to this a few days ago at FreightWaves’ F3: Future of Freight Festival:

“We’re going to have fewer supply chain steps closer to home, and the competitive nature to that is going to be very different from just waiting for things to show up at the dock. We’re going to have the need to do everything that is currently done in Asia but in fewer steps….”

Zeihan added there will need to be “.. an awareness of what the cargo is on a micro level and in each container so that anyone can go to anything at any time and find out the best way to route within the system — that’s going to require a lot more information technology.”

Reshoring and nearshoring suppliers and inventory closer to markets create competitive advantages that encourage growth during a recession:

- Minimizing logistics costs and fuel consumption.

- Reduced exposure to geopolitical conflict and domestic policies.

- Accelerating sustainability goals and promoting local interests.

- Increased efficiency, visibility, agility, profitability, and quality.

flexis Software Restructures and Manages Supply Chain Operations

Your company will need software that can analyze historical distribution patterns to identify optimal site locations for suppliers, factories, and distribution sites. flexis AG provides a full suite of solutions for restructuring a supply chain network and managing its operation.

Ten Ways Restructuring A Supply Chain Improves Transportation

Here are ten ways restructuring your supply chain to reduce geopolitical risk will increase transportation efficiency and profits.

1. Increases Shipment Consolidation

- The frequency and distance of long-haul trips decrease, increasing trailer turnover and availing trailers for spotting at shipper locations. Consequently, shippers can consolidate more shipments over time, especially those with limited warehouse space.

- Shorter transit times allow more time for consolidation.

2. Improves Carrier Utilization

- Increased shipper consolidation maximizes the use of trailer volume per vehicle.

- Smaller geographic coverage increases pickup and delivery density, maximizing the stops and shipments handled per trip.

- Higher density P&D maximizes flexibility, allowing vehicles to co-mingle pickups and deliveries, reducing fleet size, and eliminating empty returns.

- Short-hauls increase equipment turnover, restoring capacity more frequently.

- Reducing the trip length and distribution area, along with using more intermodal transport, keeps equipment closer to origin terminals, allowing dispatchers more flexibility to reroute vehicles.

4. Improves Supply Chain Visibility

-

Supply chain visibility increases due to fewer carriers, transfer points, and business systems involved in shorter-haul shipments. Less system complexity makes it easier to acquire shipment status, and shorter transit time means data is more timely between events.

5. Improves Supply Chain Agility

-

Supply chain agility increases due to better visibility, fewer logistics and systems complexity, and fewer parties involved.

-

Fewer carriers and systems in the supply chain make collaboration and systems integration more likely, improving the likelihood of carrier responses to last-minute changes and exceptions.

-

More timely data increases the value proposition of synchronizing more supply chain processes with transportation, promoting cross-functional proactivity.

-

Keeping equipment closer to origin terminals allows dispatchers more flexibility to reroute vehicles.

6. Supports Ecommerce Growth

-

Distribution closer to consumers supports e-commerce demands for faster, cheaper deliveries and returns.

-

Greater logistics agility increases responsiveness to last-minute customer changes.

-

Improved visibility satisfies customer expectations for real-time updates.

7. Increases Sustainability

-

Shipment consolidations and pooling, more productive P&D trips, better utilization of carrier resources, reduce miles, trucks on the road, and traffic congestion.

-

Eliminates long-haul trucking, air freight, and cargo ship emissions.

-

Expands the use of regional waterways, railroads, and EVs.

8. Improves Driver Retention

-

Fleets can operate at total capacity and deliver consistent service.

-

Driver quality of life improves with better sleep and more time at home.

9. Reduces Fuel Consumption

-

Eliminating long-distance trucking, air freight, and transoceanic vessels consumes less fuel.

-

Maintaining inventory closer to markets allows using regional railroads and waterways that consume minimal fuel.

-

Increased shipment consolidations and utilization of carrier equipment reduce fleet size and miles driven.

10. Reduces Geopolitical Risk

-

Crossing fewer international borders decreases government jurisdictions that can affect suppliers and transportation operations, negating risk from policies harmful to either.

-

Reduced fuel consumption from efficiency gains, shipment consolidations, and use of regional waterways and rail services reduce energy risk.

-

Energy diversification for short-haul, such as EVs and hydrogen, can be entertained in a few scenarios.

Conclusion

Restructuring your supply chain can protect it from geopolitical risks and enable growth during a recession. Your company will need software that can identify the optimal location for suppliers, production, and distribution sites.

flexis AG provides software and services for restructuring supply chain networks and managing its operation.

INTERESTED IN MORE INFORMATION?

LATEST POSTS

- Understand Circular Economy in The Manufacturing Industry

- How Can Industry 4.0 IT Integration Be Achieved Smoothly?

- The Significance of Order Sequencing in Discrete Manufacturing

- How to improve your Supply Chain Management: The Power of Control Towers

- Optimizing Human Resource Scheduling in Manufacturing: A Technological Approach