5 Ways to Protect Your Supply Chain From Asset Bubbles

Keith LaBotz - October 13, 2022

Asset bubbles are ticking time bombs for supply chains, and there’s no way to detect them. Is your supply chain prepared for the next one?

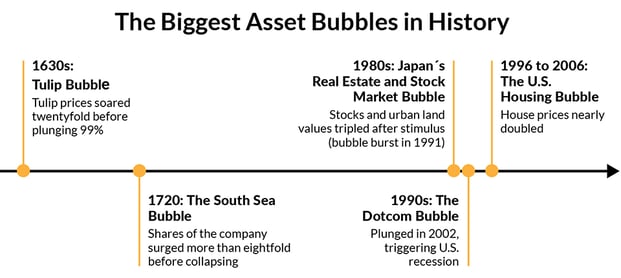

The last asset bubble, in 2006, launched the Great Recession, which famously wrecked automotive supply chains and other sectors of the global economy. It’s a repeating pattern, and current events are raising concerns.

The most devastating recessions in economic history began with asset bubbles, and to date, the efforts of governments and central banks have failed to prevent them. Moreover, the size of asset bubbles and the resulting recessions are increasing over time.

Q: What is an asset bubble?

A: An bubble is a market where asset prices inflate higher than their intrinsic value.

- Bubbles burst when demand and price decrease relatively quickly and the market contracts.

- A bubble can only be recognized in retrospect, looking at the bigger picture over time; a protracted market contraction.

- No one can predict when the bubble will burst.

- There are multiple causes of bubbles, and economists dispute them; some even deny the existence of bubbles.

Asset bubbles and recessions are disruptive and normal occurrences in economic cycles. You can think of them like market corrections on steroids, vital for restoring market health; they eliminate the inefficiencies, excess capacity, and inflated prices that build up during boom times. The problem isn't asset bubbles or the recessions they create but how you and your company respond to them.

Protecting your company from these risks is easier than you think, but it's only possible before the bubble bursts. Once that happens, it’s too late.

This article offers five ways to prepare a supply chain for the next asset bubble collapse.

Asset Bubbles are Undetectable and Unpredictable

The first step to mitigating any risk is detecting it, and being able to predict a threat is even better. The problem with asset bubbles is that they cannot be detected or predicted with certainty. There is plenty of debate on if and when highly inflated assets are due for a significant correction, but no method exists for accurately determining this.

An inflated market can suddenly crash or gyrate up and down in a volatile decline. At any point, it might unexpectedly reverse to exceed its previous highs and then crash. It might ultimately end with a crash, but at what point would you be able to identify it as a bubble?

Q: How can a supply chain mitigate the risk of an asset bubble if it can't be detected or predicted?

A: When an asset bubble collapses, a sudden decline in demand and prices produces supply chain volatility. If supply chain systems can mitigate volatility risks, it does not matter if the root cause is invisible.

That’s good news because most companies are already making process improvements to address supply chain volatility.

1. Increase Supply Chain Agility

The volatility supply chains have battled over the past two years has many companies making process improvements to increase operational agility. The quickest way to transform a supply chain is to concentrate efforts on logistics; these articles can help you with that.

The objective is not to predict or detect bubbles - there’s no way to do that reliably. The goal is agile execution, and you’ll need visibility for that: reliable data collection, forecasting, and planning.

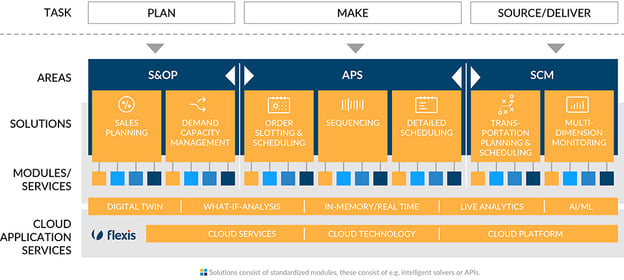

2. Cross-Functional Planning and Execution

The effectiveness of supply chain agility depends on its ability to detect changes and respond optimally. An agile response might include a combination of actions like altering production and shipping plans, modifying forecasts, and rerouting a delivery truck.

Coordinating cross-functional responses requires integration of S&OP, APS, and SCM (logistics) forecasting, planning, and execution. The flexis suite of apps enables this with cloud-based deployment and APIs so existing enterprise systems can optimize decisions.

3. Incorporate Asset Markets Data Into Forecasts

A previous post suggested that supply chain forecasts incorporate transportation market metrics to clarify macroeconomic trends. You can use this same approach for financial markets.

There are metrics for assessing the risk of bubbles for various asset classes and equity markets. These include correlations with interest rates, money supply, stock price and market ratios, and other financial mechanisms. Of course, these are speculative, but isn’t that true of all forecasts?

4. Collaborative Forecasting and Planning with Customers

Encouraging customers to share purchasing plans with your company to improve the accuracy of forecasts. Additionally, coordinating customer purchases to synchronize more closely with production and distribution plans can reduce operating costs. Your company can offer incentives to encourage customers to align procurement more closely with your goals.

5. Realtime Forecasting and Planning

Volatility accelerates with panic selling when a bubble bursts, rapidly shifting forecasts and plans. It presents a moving target, and a supply chain must continuously recalibrate its plans to stay on track. Supply chain forecasts and plans should be generated in real time so that decisions reflect current realities at any point.

Conclusion

While no one can predict when an asset bubble will burst, the five tips in this article will prepare your company for the next one. Increasing supply chain agility with cross-functional forecasting and planning is the key to staying on track in volatile markets.

INTERESTED IN MORE INFORMATION?

LATEST POSTS

- Understand Circular Economy in The Manufacturing Industry

- How Can Industry 4.0 IT Integration Be Achieved Smoothly?

- The Significance of Order Sequencing in Discrete Manufacturing

- How to improve your Supply Chain Management: The Power of Control Towers

- Optimizing Human Resource Scheduling in Manufacturing: A Technological Approach