Transportation Forecasting Makes the Best Plans Better

Keith LaBotz - August 23, 2022

Transportation forecasting is a technology that deserves the attention of supply chain leaders. Few know about it, and you are about to become one of them.

This high-impact, low-risk solution boosts the effectiveness of supply chain demand planning and transportation management systems (TMS). It’s also one of the most overlooked and misunderstood technologies, which works to the advantage of early adopters.

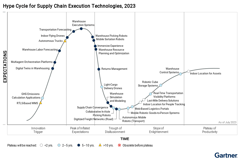

Gartner®’s Hype Cycle™ provides a graphic representation of the maturity and adoption of technologies and applications, and how they are potentially relevant to solving real business problems and exploiting new opportunities. The latest “Hype Cycle™ for Supply Chain Execution Technologies, 2022” includes transportation forecasting and recognizes flexis as a Sample Vendor. According to Gartner, “Companies must be able to forecast future transportation requirements, so they can collaborate with carriers to plan and lock in capacity.” That is what flexis products do.

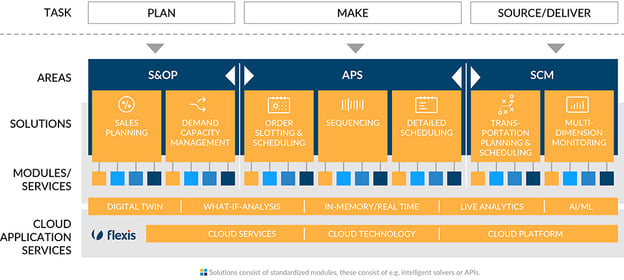

The flexis suite of apps seamlessly integrates S&OP (Sales & Operations Planning), APS (Advanced Planning & Scheduling), and transportation forecasts to make supply chain optimization possible. These three areas ideally are tightly synchronized around a holistic supply chain model to optimize the supply chain fully.

The flexis suite of apps seamlessly integrates S&OP (Sales & Operations Planning), APS (Advanced Planning & Scheduling), and transportation forecasts to make supply chain optimization possible. These three areas ideally are tightly synchronized around a holistic supply chain model to optimize the supply chain fully.

Why Transportation Forecasting is Overlooked

For a technology destined to become a cornerstone of supply chain management, it’s surprising how difficult it is to find an S&OP solution that extends into transportation and vice-versa.

Part of the problem is that S&OP forecasts overshadow transportation. Many developers do not understand the intricacy of transportation, and shipping is an afterthought for many organizations. The general assumption is that S&OP drives transportation, so shipping operations exist to support it.

Considering shipping after the fact is the opposite of using a transportation-centric model, which views all supply chain processes as supporting transportation. Introducing forecasts will reveal which end is wagging the dog and likely steer a business towards this model.

Transportation Forecasting is Not Planning - Well, Sort of

Adding to the above problem is confusion over transportation forecasting and planning. Neither activity adheres to a strict definition, and there is some overlap. Both are poorly understood outside the logistics department.

Most shipping operations employ some level of transportation planning, and outsiders often mistakenly equate it to forecasting. Here’s how this article distinguishes transportation planning and forecasting:

- Transportation planning focuses on short-term tactical decisions. Most companies evaluate constraints and cost-saving opportunities for pending shipments, usually one to five days into the future. Most companies manage planning using a Transportation Management Systems (TMS). Planning usually involves consolidating orders, sequencing trailer loading to maximize utilization, and selecting more economical transportation services.

- Transportation forecasting extends shipment visibility and planning beyond the short-term, focusing on strategic decisions. Demand forecasts are translated into granular inbound and outbound shipment details, revealing associated transportation requirements:

-

-

- The daily number of shipments, packaged weights, package and shipment dimensions, and commodities shipped.

- Transportation volume by lane, carrier, and transport mode.

- Warehouse labor, space, and equipment requirements.

- The total number of vehicles and drivers for fleet operations to pick up, deliver, and service orders.

- Carbon tonnage, labor costs, and fuel expenses.

-

Transportation Forecasting Supplements TMS

Transportation forecasting supplements traditional TMS and bridges the gap between S&OP and shipping. Integrating these functions enables the entire business enterprise process to align with shipping, removing a significant obstacle to supply chain optimization.

- Transportation forecasts can be ingested as feedback to optimize procurement, sales, production, and transportation.

- Transportation forecasts can be analyzed using predictive analytics to identify operational strategies to reduce transportation cost, risk, and carbon footprint.

- Transportation planning is improved by identifying operational changes that can take advantage of TMS capabilities. In some situations, decisions from forecasting can change the TMS’ short-range plan.

Why Transportation Forecasting is Important

Transportation forecasting is important for the same reasons as demand forecasting, and it’s arguably more significant in light of current trends.

After two and a half years of fighting a supply chain wildfire that’s not letting up, supply chains are resigned to a volatile future. Transportation networks mirror market volatility and vice-versa, so securing transportation capacity is a concern, and forecasting can help.

Forecasting Secures Transportation Services

Volatility makes it difficult for shippers and carriers to predict capacity requirements. Companies that share granular shipping projections facilitate better planning for transportation operators, mutually reducing costs and risks.

Such collaboration is attractive to carriers, and shippers with detailed transportation forecasts receive a higher priority and better pricing. With supply chain volatility expected to continue, shippers will find this collaboration is required to secure reliable transportation.

Transportation Forecasting Increases Agility

Effective forecasting improves future visibility, increasing operational agility. More preparation is possible to ensure greater flexibility and better decision. A few illustrations of how transportation forecasts improve agility follow:

- Translating demand to shipment forecasts avoids unexpected volume spikes from overwhelming shipping, allowing preparation and better pricing. Expected increases in shipment volume from marketing campaigns or product releases are examples.

- Companies gain more time to acquire resources at competitive prices and make changes to mitigate risks.

- Collaboration with transportation providers is possible to secure sufficient capacity and better pricing.

- Altering production and distribution schedules to take advantage of excess carrier capacity. Letting transportation drive scheduling when possible minimizes transportation expenses and assures sufficient capacity is available.

- Renegotiating more favorable freight tariffs and logistics contracts in advance of changes in shipping volumes to secure the best possible pricing. The timing of negotiations can work to your benefit regardless of whether future shipping volumes are expected to increase or decrease.

Conclusion

Continued supply chain volatility means process improvements must continue to improve optimization. Integrating S&OP and for OEM’s and manufacturers also Advanced Planning & Scheduling solutions, and transportation forecasts is a significant enabler of supply chain optimization, and it’s only a matter of time before it’s the norm. In the meantime, companies can gain a significant competitive advantage by implementing transportation forecasting now.

Gartner, Hype Cycle for Supply Chain Execution Technologies, 2022, Dwight Klappich, 27 June 2022.

Disclaimer:

Gartner and Hype Cycle are registered trademarks and service marks of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

LATEST POSTS

- Understand Circular Economy in The Manufacturing Industry

- How Can Industry 4.0 IT Integration Be Achieved Smoothly?

- The Significance of Order Sequencing in Discrete Manufacturing

- How to improve your Supply Chain Management: The Power of Control Towers

- Optimizing Human Resource Scheduling in Manufacturing: A Technological Approach